IDTechEx explores 2021’s most Advanced Materials

With the pandemic still raging, supply chain disruptions, the chip shortage, climate catastrophes, and geopolitical turbulence, it is safe to say 2021 has not been smooth sailing.

The materials and chemical sector provides the backbone of every industry and remains under pressure from all these challenges. Within this field, there will always be the need to push the research, development, and deployment of new advanced materials in response to any market drivers. In this article, IDTechEx highlights the key news from their independent perspective on this crucial industry.

Commercial movement: mergers & acquisitions

Mergers & acquisitions are common but 2021 has seen some highly notable changes. Materion with acquired H.C Starck’s electronic materials portfolio, Heraeus acquired HS Advanced Materials, Boyd Corporation acquired Siltec, Sun Chemical, and DIC acquired a BASF division, and even outside of the chemical giants WD Lab Grown Diamonds acquired J2 Materials. It was not all success stories, in March Applied Materials walked away from their plan to acquire Kokusai Electric.

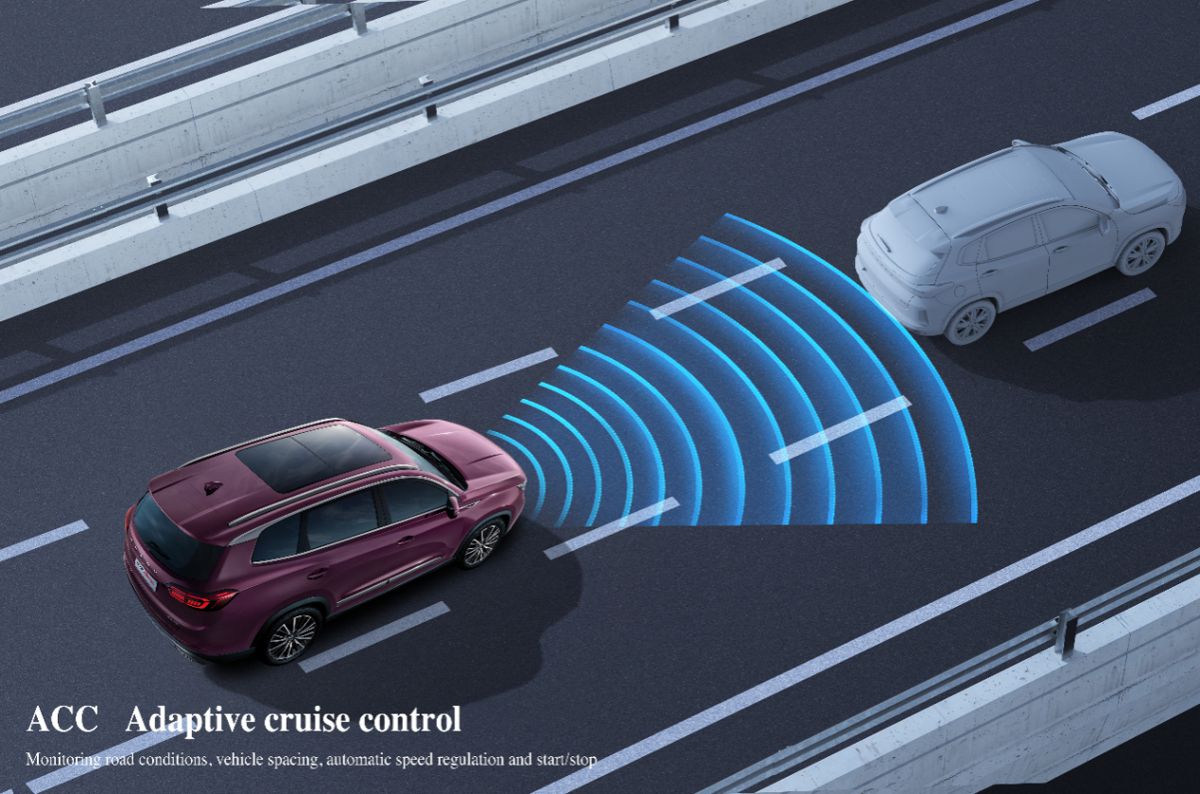

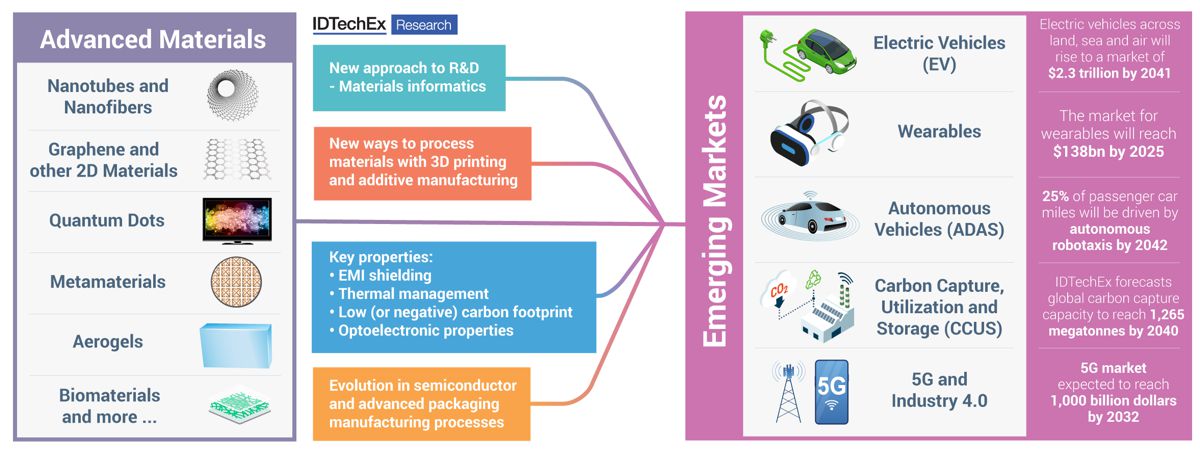

The most notable 2021 news was certainly from DuPont and their significant acquisition of both Laird Performance Materials (completed in July) and of Rogers Corporation (agreement announced in November). In both cases, they become part of DuPont’s Electronics & Industrial business unit and cited autonomous vehicle as a key market, beyond that the Rogers acquisition boosts the capability for electric vehicles and Laird expands the reach into high-performance computing, AI, 5G, and IoT. The material portfolio and capabilities are broad but certainly center around some of the key challenges facing these industries such as thermal management and EMI shielding.

Public and Private Funding

2020 and into 2021 has been the boom of companies going public by merging with a SPAC. This trend has been seen in the advanced materials world and in closely related industries with materials at their core such as 3D printing (with the likes of Markforged) and energy storage (with companies like Enovix). For materials, the most notable is Meta Materials (which was NASDAQ-listed from June) who are leaders in the exciting emerging field of metamaterials that is looking to impact a wide range of sectors from consumer electronics to 5G, healthcare, aerospace, and beyond. The other advanced material company to be highlighted here is Origin Materials (also NASAQ-listed from June) with their sustainable carbon negative materials. There is plenty of excitement, but also a significant amount of turbulence and bad news with some of these early-stage public companies; this was seen with Meta Materials price but is best seen for Zymergen (IPO in April 2021) who are using synthetic biology for a variety of products but with the initial commercial target being a polyimide film and in August saw a sharp drop off when stating its 2022 revenue would be “immaterial”.

Of course, it is not just the public funding that is important to track. We have seen notable private funding rounds and announcements from those on the early-stage and smaller scale, such as C12 Quantum Electronics raising $10m for their work on CNTs for quantum computers, Stoicheia ($5m) for their advanced materials discovery process, and DiviGas ($3.6m) and Osmoses ($3m) both for novel membrane technology, to those further along such as CHASM Advanced Materials ($15m) with their nanotube hybrid developments, Via Separations ($38m) with their graphene-oxide membrane platform, and Continuous Composites ($17m) for 3D printing thermoset FRPs and all the way to larger money to really help grow their commercial deployment such as with Phononic ($50m) with their bismuth telluride thermoelectric cooler, ARRIS Composites ($88.5m) for advanced composite manufacturing and Plastic Energy (€145m) for the chemical recycling of plastic waste. There are countless more beyond this and certainly the appetite for funding, even in some industries that will not see a return for longer than most, has not diminished.

Partnerships

Funding and acquisitions are important, but strategic partnerships and agreements can be essential to the success or failure of any emerging material. As with the previous sections, we have seen this with numerous sectors such as Solvay and 9T Labs for composites and countless in chemical recycling in plastic waste. IDTechEx has identified the field of materials informatics as one where some of the more eye-catching partnerships have been seen, this topic relates to using data-centric approaches to accelerating materials R&D. Materials informatics has seen engagement from many big chemical and materials companies with key external providers, but in 2021 the partnerships with large engineering simulation/software firms was the stand-out news with Citrine Informatics and Intellegens joining forces with Siemens and Ansys, respectively.

Production Begins and Expansions Arrive

One of the hardest parts in the commercialization of any material is achieving notable volume outside of a lab-based pilot scale. We have seen this jump for some exciting materials including NAWA Technologies and their VACNTs (vertically aligned CNTs) that entered the first stage of their industrialization production in August and General Graphene Corporation launching their high-capacity roll-to-roll production line for CVD grown graphene.

Then on more mature advanced materials are seeing some key expansions. In green materials this includes Green Dot starting the work to double their bioplastic capacity, Braskem increasing their green ethylene production, and NatureWorks getting the green light to build a second PLA facility. Thermal interface materials are not the most exciting material category, but with increasing thermal management demands present an essential and growing market resulting in expansion announcements from Wacker, Elkem, and DuPont. The aerospace market is a key driving force behind many advanced materials and has been one of the most notable sectors significantly impacted by the pandemic, recovery is on the way as shown by Airbus receiving their first major order in November, but it still presents challenges for those in their supply chain. One such material is carbon fiber, but it is not all bad news for those players with Zoltek announcing an expansion of their large-tow fibre to meet the wind market demands.

The final area to explore for 2021 news is in the ultimate end-goal, product utilization. Here we will look at two sectors: electronics and energy storage.

Applications: electronics

The electronics industry has been dominated by the semiconductor news in 2021, mostly surrounding the chip shortage but also with excitement around TSMC and IBM 1nm and 2nm chip announcements, the role of ASML’s extreme ultraviolet (EUV) lithography technology, and regional expansion plans.

Outside of this, there have been some interesting developments. Apple rumors and leaks around their next phone and AR/VR headset suggest that they will adopt the Wi-Fi 6E protocol requiring notable LTCC (low temperature cofired ceramics) substrates to be adopted. The quantum dot industry saw excitement from its most promising sector of displays, where acceleration and competition continued apace including indications that Samsung’s QD-OLED TV is set to arrive in 2022, through to earlier-stage markets such as UbiQD installing solar windows on commercial buildings. Nanomaterials continue their progression across sectors, with examples like Nanowear and their nanofiber-enabled wearable for remote patient monitoring gaining further FDA clearance.

Applications: energy storage

Energy storage remains one of the key areas for materials R&D. Money continues to pour in, but the market is challenging typified by Johnson Matthey announcing in November the intention to exit battery materials.

When looking at next-generation materials graphene batteries still grab the headlines, most notable with GAC making several showcases and announcements on their graphene-enabled fast-charging solution. Lithium-sulphur appeared to take a step backwards with Oxis Energy facing bankruptcy and entering administration in May (Johnson Matthey acquired the IP), but also saw some progression enabled by early-stage materials including Lyten coming out of stealth mode with their “3D graphene” solution and Li-S Energy showing some promising results with boron nitride nanotubes (BNNTs) and LG Chem and NextTech also making key announcements.

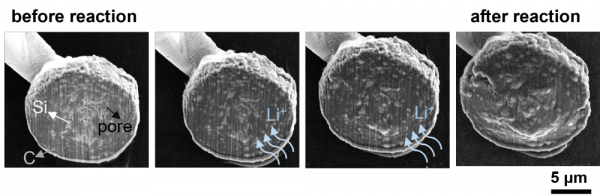

There are other materials that are much more likely to make a more immediate or lasting impact on the next generation of battery cells, with silicon anodes and solid-state batteries two essential areas.

The cell chemistry is what grabs a lot of the headlines, but it is foolish to overlook those improvements taking place within the pack. One exciting advanced materials news here is the use of silica aerogel composites to act as thermal runaway barriers, this has been seen previously in China and has now seen significant progression with Aspen Aerogels announcing orders from a North American and Asian OEM.

Outlook

It is now important to turn our attention to the coming year and what we might expect to have a disruptive impact. Certainly, solutions that enable key market drivers in telecommunications, semiconductor manufacturing, energy storage, and the circular economy will continue to hold a high demand as well as those in the next generation of electronics from augmented reality to sensor deployment for industry 4.0 and personalized healthcare monitoring. As a result, do not be surprised to see more the much-overhyped era of nanomaterials to quietly gain further commercial traction.

Then there will be those material developments for those revolutionary but further afield applications such as fully autonomous vehicles, quantum computing, and neural interfaces. Finally, 2022 will continue to see the evolution in how materials are researched with materials informatics approaches and how they are generated and processed with the likes of synthetic biology and 3D printing. Materials science and the progression of advanced materials will rarely be the headline but is an essential part of any and all innovations.